High rolling City clients are deserting him, so should you give the fallen star the boot when you can?

A week is a long time in politics – and finance too. Just ask Neil Woodford, one of the biggest star fund managers the UK has ever seen, who ended last week with his reputation in tatters.

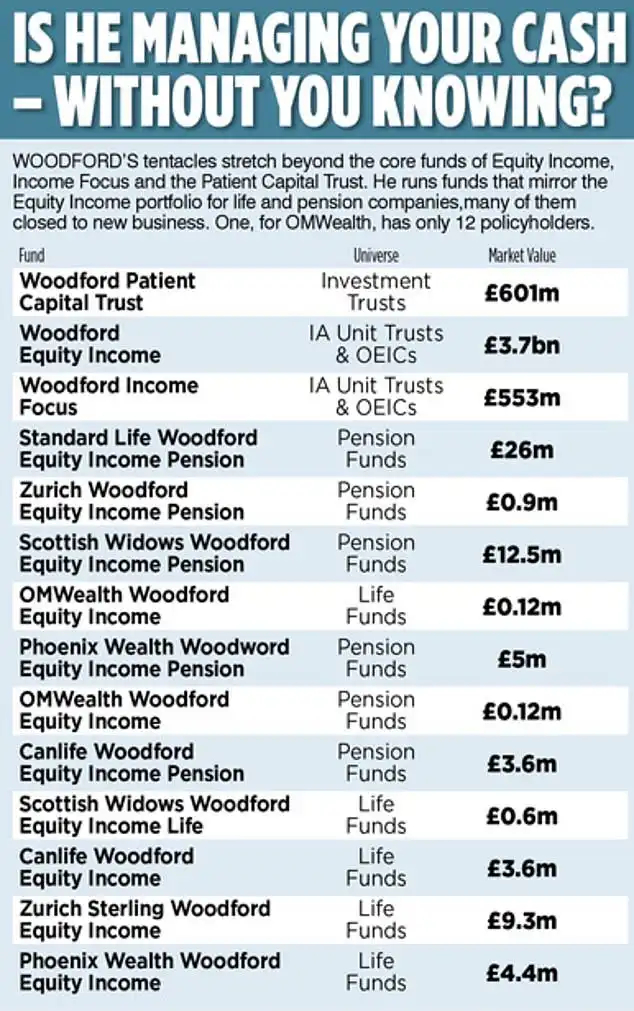

After trapping thousands of private investors – and £3.7billion of their savings – in his Equity Income Fund, Woodford’s high-rolling City clients started to abandon him one by one.

First, his biggest cheerleader, stockbroker Hargreaves Lansdown, ditched the fund from its favourites. Then St James’s Place, the giant wealth manager, said it would no longer trust Woodford to manage £3.5billion of clients’ money.

It has left ordinary investors asking whether they, too, should be preparing to jump ship or hang on in the hope that Woodford will turn it around.

If you have money in the suspended Equity Income fund, cashing in won’t be possible for another three weeks at least – and experts say the lock-in could last months.

In that time a lot could change in the markets, but some experts think the writing is already on wall for Woodford.

If your money is in another Woodford fund, such as the Income Focus or Patient Capital Trust, you are free to leave at any time.

Justin Modray, of Candid Financial Advice, says: ‘It is hard to see how Neil Woodford will forge a path forwards from here. When the fund does finally reopen I suspect many investors will be chomping at the bit to simply get out and move on.’

He adds: ‘It’s hard to muster the confidence that he will bounce back after some disastrous stock picks in recent years including Provident Financial, The AA, Kier Group and Purplebricks. We finally lost patience early last year and recommended our clients get out.’

Retired chartered surveyor David Pearse is one of thousands hoping to escape.

He put a five-figure sum into Woodford’s much-plugged fund at the time of its launch in 2014 – but now he wants out.

The investment formed part of the 72-year-old’s self-invested personal pension. He says: ‘In light of the way Woodford has behaved, taking huge sums of money out of a failing fund, I’m ready to ditch him at the earliest opportunity.

‘Unfortunately there’s only been one winner in the Woodford Fund – Neil himself.’

Alarm bells have been ringing for months – even years – over Woodford’s Equity Income fund.

Investors have steadily falling out of love with both its performance and share picks.

An over-exposure to hard-to-trade illiquid stocks has made clients nervous.

Jason Hollands, of wealth manager Tilney, cited this as one of the reasons that his company ditched Woodford from its list of highly-rated funds more than a year ago.

‘We were worried about the way he was positioning the funds – the type of shares he was buying – because it was very different to his previous portfolio at Invesco, where he was so successful. But if you are still invested, whether to sell is not a decision to take today.

‘When the news is so bad, it’s easy to think ‘just get out’. But you need to let the dust settle.

‘I don’t think this is going to be fixed in 28 days. It could be a number of months, and lots can happen in the meantime. For example, the clouds could lift off the UK market if Brexit is finally resolved.’

… if you do, which funds can you trust with your nest egg?

Only when Woodford lifts the suspension on his Equity Income fund can investors make an informed decision about what to do next, the experts say.

Damien Fahy, director of consumer website MoneytotheMasses, says: ‘Selling or staying will depend on whether Woodford has managed to stop the rot and turn the fund around.’

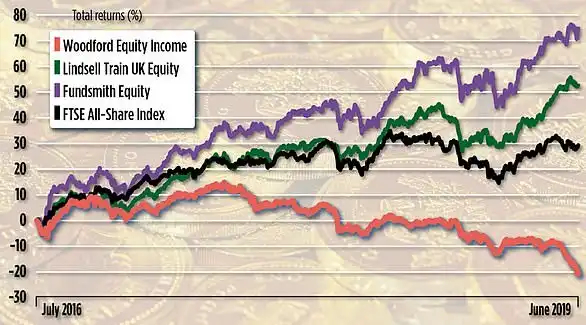

Many savers will undoubtedly be looking for other star fund managers – the likes of Terry Smith and his Fundsmith Equity fund, or Nick Train with his Lindsell Train UK Equity fund who have consistently outperformed Woodford (see graph). But investing experts say there are plenty of lesser known funds doing a sterling job.

Adrian Lowcock, of Willis Owen, says there are plenty of excellent ‘equity income’ fund managers who try to deliver payments to investors from dividend-paying stocks – one of the reasons many investors chose Neil Woodford in the first place.

He adds: ‘Many offer a core, fully liquid portfolio suitable for investors seeking income and to protect their capital. Equity income shouldn’t be about taking unnecessary risks.’

One fund to consider is JOHCM UK Equity Income fund. It has a strong record of growing income payouts and a yield of 4.29 per cent.

It invests just over a fifth of your money in small companies from the FTSE Small Cap Index, while £63 in every £100 is put into larger FTSE 100 companies such as HSBC and BP. Another is Rathbone Income fund, focused on delivering income with some capital growth. It concentrates on mid-sized businesses.

JOHCM UK Dynamic fund is an alternative. Patrick Connolly, of adviser firm Chase de Vere, says: ‘It includes a steady yield, currently 3.4 per cent, as it only invests in dividend payers. Microcaps don’t get a look in.’ A fund combining income and growth is Blackrock UK Income.

Fahy says: ‘For something outside of the established players there is Kames UK Equity Income fund.’

It favours financials and invests £73 of every £100 in big businesses, with minimal investment in smaller companies.

Justin Modray, of Candid Financial Advice, says: ‘I can well understand those investors who do exit wanting to shun active fund management after this experience. In which case the Vanguard FTSE UK All Share Index tracking fund is a sensible option. It’s a very low cost fund with no unquoted shares in sight.’

But he says Colin Morton’s Franklin UK Equity Income fund and Lindsell Train UK Equity are both still worth a look.

Modray adds: ‘Both managers couple very sensible investment strategies with competitive annual charges.’

How The Equity Income Fund Fell Behind

The performance of the fund has been miserable after a good start.

Over the past three years, the Equity Income fund has fallen 20.4 per cent – even though companies in the FTSE All-Share index have risen 29.3 per cent on average.

Jonothan McColgan, a chartered financial planner at Combined Financial Strategies, says this was one of the reasons he didn’t recommended Woodford’s new funds after waiting three years to see if he could repeat his exploits at Invesco Perpetual.

‘It’s always really hard to know if past performance has all been down to just the fund manager or because of the processes of the team and company behind them,’ he says.

‘I do not think I could justify using Woodford in the future for clients. What he did with unregulated investments has really shattered any trust an adviser should have in him. Unfortunately, he tried to game the system so that he could invest a higher proportion of his fund in unregulated investments than he should have.’

Brian Dennehy, of information service FundExpert, has long warned that Woodford’s star was on the wane.

He says: ‘We’ve never recommended the fund. We’ve highlighted before the problems with his performance even before leaving Invesco.

Was I Blinded by His Inspiring Back Story?

By Toby Walne

Wishing to invest £10,000 in my newly opened self-invested personal pension four years ago I chose to throw the lot into the Woodford Equity Income Fund.

A sucker for success stories, I was dazzled by Neil Woodford as a fund manager with an incredible track record.

At Invesco Perpetual he turned £10,000 into £230,000 in 25 years. I was already spending the profits in my head.

As an inverted snob with a chip on my ill-educated shoulders, I also liked the idea Woodford did not go to public school or have a daddy to find him a job in the City.

I imagined he had to knuckle down to set himself apart from the pin-striped toffs – and it was refreshing that he managed money out of an industrial estate in Oxford.

The final attraction was that Woodford is a well-known contrarian investor who runs against the pack – refusing to plough cash into tech during the late 1990s before the bubble burst, or into banks in the mid-2000s before the financial crisis.

But now I’m worried that rather than dazzled, I was blinded by Woodford’s back story. In reality, this legendary money manager has turned my £10,000 into about £8,200.

Even if I had simply stuffed money under the mattress, I would be £1,800 better off. I am now starting to feel nervous. Woodford will not allow me to jump ship having closed the gate temporarily.

But as I believe investing is a long-term gamble, I’m worried quitting when I’m down, and he’s restructuring the fund, could be a mistake I’ll regret.

‘We have reviewed the fund every year since launch. And on June 2 we looked again – as it hit its fifth birthday – when we highlighted again the poor performance and that anyone who had it should sell.

‘A lot of people are saying he is very skilled. People never know the difference between luck and skill – you just have to look at the evidence.’

Part of his philosophy of keeping his eyes on all of the facts is never to meet the managers.

The risk, he believes is that their charm and persuasive patter can only distract from making a rational decision on whether to invest.

James Baxter, of financial planning firm Tideway Wealth, says Woodford’s fatal mistake was to change his investment style.

‘I don’t know how Woodford can get away with owning some of the unquoted stock he did in a fund marketed to retirement folk – it is style drift by a mile and beggars belief,’ he says. ‘There is a real problem if investors think they are buying a retirement fund but that fund is doing something quite different.’

Adrian Lowcock, head of personal investing at broker Willis Owen, says: ‘The fund has not featured in any of the Willis Owen starter portfolios, chiefly because these were designed for new investors, and therefore we considered funds which offered long-term performance but at the right level of risk.

‘Until things have settled down and we can get a clearer idea of where the land lies we have no plans to add Woodford for the foreseeable future.’

Keith Richards, chief executive of the Personal Finance Society, the leading organisation for chartered financial planners, says: ‘Private investors are right to be furious about not being able to access their hard-earned investment savings.

‘To pull the rug from under their feet is not only a betrayal of the trust and faith they had in Woodford, but also a serious blow to overall investor confidence in a volatile investment climate.’

Retired investor David Pearse says the main reason he invested was because of Woodford’s track record and the ‘strong support shown by Hargreaves Lansdown’.

He repeatedly questioned the broker’s unwavering support for Woodford’s fund given its poor performance, resulting in him receiving a personal call from the company’s head of research Mark Dampier.

‘Dampier’s view was that Woodford had come through similar setbacks before and that they still had faith in him,’ he says.

He accepts Dampier’s words were comment and not advice.

‘However, I was very concerned to hear reports that there were significant sums invested in unquoted, difficult to sell companies,’ he adds. ‘I was investing in a fund for income, so I was surprised to find substantial investments in non-income producing young companies.’

For now investors can do nothing but sit tight and wait. On the plus side, those drawing income from the fund should be fine. Modray says: ‘The funds should still pay out underlying dividend income – paid quarterly and next due in August.’

Holding The Fund Was a Mistake, But I Had Patience With The Trust

Simon Lambert, Editor of This is Money

Last month, Woodford outlined why he thought a Brexit deal would finally be done and his stock picking would come good.

‘If Brexit pans out as I believe, we will see a long overdue and significant rally in sterling – and this will have a meaningful impact on the UK stock market,’ he said.

I wrote at the time that it seemed like a logical argument: a swing in the value of the pound and sentiment in the UK would boost shares in Woodford’s favoured companies, which earn most of their income from the domestic economy.

I hold both Woodford’s Equity Income Fund – the one suspended – and his Patient Capital Trust and I felt that, despite some examples of poor judgment with some high-profile companies, his strategy had a strong chance of ultimately being proved correct.

I knew Woodford’s style had drifted and that there were more smaller companies in the fund, but he had been clear with investors what was in there – publishing a full list of holdings each month – and I am happy to take more risk with my investments. His fund also only represented a small part of my Isa portfolio.

I still think my patience was the right move with the Patient Capital investment trust, but perhaps not with the big fund.

Sticking with the Equity Income Fund too long has meant a missed opportunity to invest elsewhere – and now I’m trapped.

Had I put the money I had in Woodford’s Equity Income fund into a rival, I would have had far more money. Over the three years to the day that fund was shuttered, Woodford’s slid 17.5 per cent, while the average UK All Companies fund climbed 23.3 per cent.

The opportunity cost of holding Woodford’s fund over even the average one was almost 41 per cent over that period – that’s a big gap.

With his Patient Capital Trust I’m happier to do what it said on the tin and be patient. Although I can’t escape the nagging concern that now the trust also risks being dragged into the mire and the exciting investments in it will not pay off.