The Steady Eddie Guide to Asset Allocation

- Retail investors jettisoned a net £10billion of investment funds in March

- Experts say those who have held on to their investments should review them

- Someone who invested in a broad portfolio of stock market-listed investment trusts a year ago is now sitting on investment gains despite the market trauma

As we know all too well, given the testing stock markets conditions of recent months, investing for the long-term requires nerves of steel.

Often, it means resisting the temptation to sell when markets are plunging – and, instead, be plucky and buy when most other investors are heading for the exit doors.

Sadly, but understandably, it’s an approach that many investors are not prepared to take on board.

In March, when stock markets plummeted, investors shed their investments as rapidly as naturists remove their clothes at the sight of a nudist beach sign.

According to statisticians at the Investment Association, retail investors (the likes of you and me) jettisoned a net £10 billion of investment funds in March.

In other words, we ran for the hills in our millions, crystallising losses (bad news) or gains (acceptable) along the way. We panicked when we should have held strong.

Roger Clarke is a partner at financial adviser The Private Office. He says such a reaction is predictable, but urges investors to try to resist it when markets fall again (which inevitably they will).

He explains: ‘Emotions run high when stock markets are falling. As an investor, the most important thing to do is try and keep a level head – and not make any knee-jerk decisions based on catastrophe outcomes and a fear that equity values will continue to fall.

‘History tells us that stock markets, sooner or later, recover. Investors must take a long-term view.’

The Rebound Gives You Breathing Space to Rebuild

It is sound advice – and proven by the strong bounce back in shares since the dark and rather scary days of March.

Indeed, as we show in the box below, someone who had invested in a broad portfolio of stock market-listed investment trusts a year ago is now sitting on investment gains despite the market trauma. (We used the example of a £100,000 portfolio divided among ten major investment trusts.)

But if they had disposed of their investments on lockdown day (March 23), they would have suffered losses of more than 28 per cent. Food for thought.

Yet for canny folk who have held on to their investment portfolios and Isas – and maybe bought more shares into a falling market – Clarke says they should not now sit on their hands and feel content with investment life.

Far from it. He believes they should use the weeks ahead to review their investments to ensure they still tick all their boxes – in terms of striking the right balance between investment risk and reward, and providing a diversified portfolio of assets that will give them a fighting chance of achieving their ultimate goal (for example, a war chest to see them through retirement or a sum big enough to clear an outstanding mortgage).

Key to this is ‘rebalancing’ – a process that involves taking a step back from the madding investment crowd and checking your portfolio is still set up in a way to meet your objectives.

Such ‘rebalancing’ should be carried out on two levels. First, in terms of your overall assets (macro level) and then more specifically with regard to your holdings of shares and investment funds.

Aim for a ‘Broad Church’ of Assets

According to Jonothan McColgan, an investment expert at financial adviser Combined Financial Strategies, those building wealth should have exposure to four main asset classes in addition to the value in their home and a standalone cash reserve for emergencies.

These are:

- Cash (safe despite poor interest rates)

- Bonds (income-generating and issued by both governments and companies)

- Commercial property (normally income-producing when the economy is not grappling with lockdown, a deserted high street and empty offices)

- Equities aka shares (volatile but producers of long-term investment gains and dividend income)

- The idea behind holding such a broad church of assets is to provide diversification.

“Different assets perform well at various times. Everything will get its day in the sun – Jonothan McColgan“

He explains: ‘None of these assets, apart from cash if you reinvest the income, will go up in value all the time. As we move through economic cycles, different assets perform well at various times. Everything will get its day in the sun.

‘Equally, the sun will also stop shining on each and every asset at some stage. This means it is important to have variety in the assets you hold. In other words, a diversified portfolio.’

A ‘cautious’ client will have more than 50 per cent of their assets in cash and a third in fixed interest – with just 8 per cent exposure to equities and an even smaller holding in property

How Much of Each Should You Hold?

In what proportions these assets are held depend upon someone’s attitude to investment risk. This ‘attitude’ is determined by a number of factors including age.

So the younger you are, the longer time horizons you will have and the more investment risk you will probably be prepared to take on board.

McColgan divides his clients into five categories according to their appetite for risk – ranging from ‘cautious’ through to ‘adventurous’. He then builds portfolios to fit.

So, for example, a ‘cautious’ client will have more than 50 per cent of their assets in cash and a third in fixed interest – with just 8 per cent exposure to equities and an even smaller holding in property.

On the other hand, a ‘balanced’ client – middle of the road in terms of risk – will have 35 per cent in bonds and the rest in equities.

Yet these percentages will change as the asset classes perform differently – McColgan refers to it as ‘drift’.

He then rebalances the portfolios by selling a slice of the assets that have done well and buying into those that have performed badly. He says investors should rebalance when an asset class increases or falls by 10 per cent or more.

Although McColgan does the rebalancing for clients (of course, with their permission), DIY investors do not have someone to advise them.

But he says most investors, armed with no more than a calculator, can work out how their wealth is divided up between the different asset classes – and whether it is time to do a spot of rebalancing by buying and selling.

A good approach, says Laura Suter of wealth manager AJ Bell, is to set up a computer spreadsheet of your portfolio by asset class.

You can then periodically revisit it to see whether the current portfolio still matches your original plan – and if some assets need to be sold down and others bought.

She adds: ‘It’s hard to sell some assets that have risen in value and reinvest them into ones that have underperformed. Psychologically, it’s a big step, but if you still believe the asset mix you started with is right, you should feel comfortable doing this.’

Some Funds Will Do The Work For You

An alternative is to hold investments that do both the asset allocation and rebalancing for you.

There are plenty of investment funds that do this, categorised according to their exposure to equities – although they are somewhat crude.

They can be easily found by visiting website Trustnet.com and looking in the unit trust universe for funds within the three ‘mixed investment’ sectors.

They range from the cautious (less than 35 per cent equity exposure) through to the more adventurous (between 40 and 85 per cent of their assets in shares).

For example, investment company Vanguard provides a range of so-called ‘life strategy’ funds that vary according to their split between bonds and shares. So, as its name implies, the LifeStrategy 20% Equity Fund has a fifth of its assets in shares – the rest in bonds.

A fund ideal for cautious investors who know their exposure to equities will never exceed 20 per cent (Vanguard does the necessary rebalancing). At the other end of the spectrum, the 80% Equity Fund has four fifths of its assets in equities.

The performance of the two funds reflects their asset mix. Over the past six months, the 20% Equity Fund has posted positive gains while the 80% Equity Fund hasn’t. But over the past five years, it is the 80% Equity Fund that has delivered the better returns.

A number of wealth platforms such as AJ Bell, Hargreaves Lansdown and Interactive Investor offer their own labelled funds that do the same thing – rebalancing as they go along.

Wealth advisers Nutmeg and Wealthify also provide diversified portfolios with different asset splits according to an investor’s stomach for risk.

Rebalancing a Share Portfolio is Vital

Ensuring your financial assets are broadly diversified – and regularly reviewed – is key to accumulating long-term wealth. Nowhere is this more important than with equities where investors’ portfolios can get out of kilter because of variations in the performance of global stock markets.

The point is best illustrated.

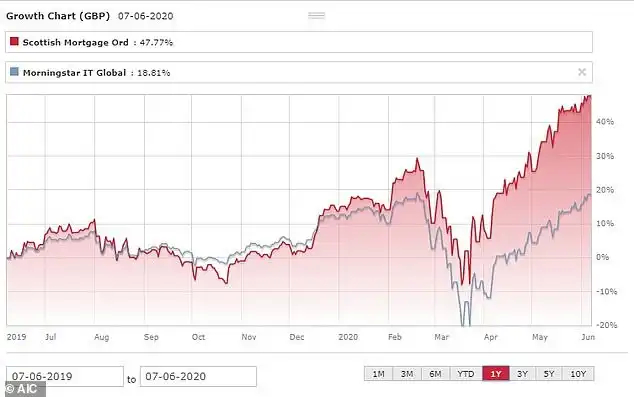

The Mail on Sunday asked the Association of Investment Companies to put together a portfolio of ten stock market-listed investment trusts that a year ago would have provided an investor with broad exposure to global stock markets – but with the biggest slice of money in the UK market.

We assumed £10,000 was invested in each trust – a mix of global, UK, emerging market and European funds.

We have then looked at a) how the portfolio has performed and b) whether the exposure to stock markets has changed and if rebalancing is required.

The results as shown in the table (above) are fascinating:

The first point to make is that a well diversified portfolio can provide all-important protection. Over the past year, the £100,000 investment has still grown in value to nearly £105,000 despite the alarming market corrections in March.

But if investors had sold out on the morning of the country’s lockdown, they would have crystallised losses of more than 28 per cent.

In terms of rebalancing, the portfolio as a whole now has more exposure to the US stock market than it did a year ago – and less in the UK.

This is a result of the strong performance of the US stock market reflected in the gains made by trusts Scottish Mortgage and Mid Wynd International – managed by Baillie Gifford and Artemis respectively, with portfolios heavily skewed towards the United States.

There would therefore be a strong rebalancing case for taking some of the profits on these two funds and investing the proceeds into the two UK invested trusts – BlackRock Smaller Companies and Schroder UK Mid Cap.

But as Annabel Brodie-Smith, communications director at the AIC, says: ‘Of course, investors should always bear in mind that rebalancing is likely to involve trading costs. So it may be sensible to allow a small ‘drift’ away from your target geographic allocation before going down this route.’